Why China?

Queensland and China share deep cultural, social and economic ties dating back to the 19th century, when Chinese migrants worked in the goldfields of North Queensland and helped to establish the region’s agricultural industry.

Today, China is Queensland’s largest trading partner and remains vital to our State's future prosperity.

It is also a significant source of foreign investment to Australia, and the state’s largest source of international student enrolments.

Queensland-China Trade and Investment Strategy 2025

Our Queensland-China Trade and Investment Strategy 2025 strengthens the Queensland-China trade and investment relationship to support our clients, investors, and education providers to achieve commercial success and jobs growth in key opportunity areas.

It identifies strategic priorities to support business opportunities in areas such as health, advanced manufacturing, energy, food and agribusiness and education and training.

This Strategy reflects Queensland’s commitment to strong partnerships across China.

Watch our Greater China Market Update Webinar

Queensland’s Senior Trade and Investment Commissioner for Greater China, Rhett Miller and guest speaker David Olsson AM, National President and Chair of the Australia China Business Council, share insights on China’s economic outlook, the new Queensland-China Trade and Investment Strategy 2025 and opportunities to further grow Queensland trade, investment and education outcomes with our largest trading partner.

China is the world's second largest economy, driving one-third of global growth

![]()

China is Australia's fifth largest source of foreign direct investment

*Combined total of Mainland China and Hong Kong Special administrative region.

![]()

China is Queensland's largest trading partner and export market

Key partnerships

Queensland has strong market access for exporters offered by free trade agreements.

These include the China-Australia Free Trade Agreement (ChAFTA), Australia-Hong Kong Free Trade Agreement (A-HKFTA), and Regional Comprehensive Economic Partnership (RCEP).

The China-Australia Free Trade Agreement (ChAFTA) has enabled Queensland businesses to benefit from agreed tariff reductions across a range of exports. ChAFTA eliminates or reduces tariffs on exports like coal, LNG, beef, dairy, wine, and various manufactured goods. Additionally, it enhances market access for Australian services sectors such as education, healthcare, and finance.

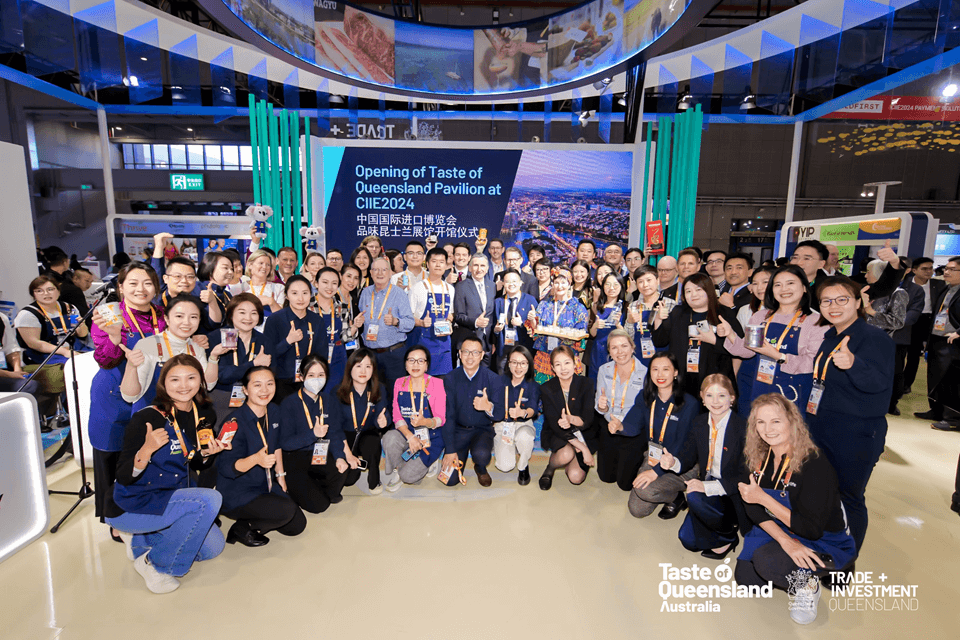

Queensland exporters and delegates at China International Import Expo (CIIE).

Attractive opportunities for Queensland businesses

China now possesses the world’s largest middle class and continues to offer significant opportunities for Queensland companies.

Queensland’s export strengths continue to complement Chinese demand and offer opportunities across food and agriculture, complementary medicine, health, design and education.

Opportunities for investment and partnerships exist in commercially viable renewables, traditional energy, infrastructure and advanced manufacturing.

Buyers connecting with Queensland exporters at China International Import Expo (CIIE).

Opportunities and challenges

- Projected growth of e-commerce and rising disposable incomes in China’s lower tier cities are opening new export opportunities for Queensland’s food, agriculture, and health products.

- The Greater Bay Area’s focus on connectivity, market access, and innovation offers potential for Queensland firms in health, design, digital trade and infrastructure.

- China’s demand for high-quality healthcare and clinical trials continues to grow, creating a strategic opening for Queensland’s capability in these areas.

- Queensland can partner with China to support its continued need for traditional energy as well as investment and partnership in commercially-viable renewables.

- China’s focus on addressing youth unemployment and further development of higher education and vocational training creates opportunities for Queensland to expand partnerships in skills-based education and career-focused learning pathways.

- Favourable market access for Queensland exporters exists through trade agreements such as ChAFTA, RECP, and A-HKFTA.

- Queensland’s collaboration with the Australia China Business Council (ACBC), Austrade and DFAT strengthens bilateral trade and investment ties by providing a platform for Queensland businesses to engage with Chinese counterparts, access market insights, and participate in high-level policy and industry dialogues.

- The Australia-China bilateral relationship is complicated owing to the fact that each has different political systems as well as differences in views on a range of important issues.

- The application of trade restrictions and tariffs by the US on China will likely weaken gross domestic product (GDP) growth of the latter and may weaken demand for key Queensland exports, especially commodities.

- Economic headwinds including a struggling property sector, overall weak consumer sentiment, and youth unemployment will likely continue to limit GDP growth.

- A complex and sometimes rapidly changing regulatory landscape in and in relation to China can present risks and challenges for Queensland businesses.

Greater China major activities FY25–26

Where: Hong Kong

Details: Promotional activities delivered in partnership with Avocados Australia during Asia Fruit Logistica to expand business opportunities for Queensland avocado growers among importers, buyers, distributors and retailers in Hong Kong.

Where: Shenzhen

Details: A showcase event in partnership with the Shenzhen Bay Marina Club to promote Queensland beef and red meat products to importers, buyers and distributors in Shenzhen during the Shenzhen Bay International Boat Show.

Where: Shanghai, Chengdu, Chongqing

Details: Queensland Food and Agriculture Pavilion at the world’s largest import-themed trade event, CIIE, to promote packaged food, beverages, health and wellness products, wines, meat, seafood and fruit to importers, buyers and distributors. TIQ will also organise an optional extension program for Queensland delegates to showcase their products in Chengdu and Chongqing.

Where: Guangzhou, Shenzhen, Hong Kong

Details: Workshops with education agents and institutional partners focused on boosting recruitment and partnerships for Queensland education providers across the higher education, VET, schools, ELICOS and student accommodation sectors.

Where: Hong Kong

Details: A product showcase and networking event in partnership with MLA to promote Queensland beef and red meat products to local importers, buyers and distributors in Hong Kong.

Where: Macau

Details: A promotional event in Macau targeting five-star hotels to showcase Queensland food products and grow exports of beef, seafood, fruits and other food products.

Where: Beijing, Shanghai

Details: Study Queensland booth at one of China’s largest education events, CIEET, to promote recruitment and partnerships for Queensland education providers in the higher education, VET, schools and ELICOS sectors.

Where: Beijing

Details: A talent employability session in partnership with CSCSE to continue repositioning the Study Queensland brand as employability-focused, promote career support for students and graduates, and facilitate opportunities for joint programs.

When: April-May 2026

Where: Shanghai, Beijing

Details: Seminars and business matching events to promote Queensland biomedical research and clinical trial capabilities and potential collaborations with Chinese pharmaceutical companies.

Where: Shenzhen

Details: Reception with Queensland education providers, local alumni and members of the local business community in Shenzhen, focusing on the healthcare industry and professional networks.

Meet Rhett Miller 雷米乐先生

Queensland Senior Trade and Investment Commissioner – China

Rhett Miller commenced as Queensland’s Senior Trade and Investment Commissioner to Greater China in August 2023.

He is responsible for leading Trade and Investment Queensland’s team in Mainland China and the Hong Kong Special Administrative Region.

Rhett has extensive experience in international market development having previously worked with Austrade as Trade and Investment Commissioner and Deputy Consul-General (Commercial) at the Australian Consulate-General in Chengdu and Trade Commissioner (Education) (North Asia) at the Australian Consulate-General in Shanghai.

Resources

Global markets

Explore more global market profiles Trade and Investment Queensland have expertise in:

Is your business ready to unlock global markets? Learn more about your future export success through TIQ.

Whether you are an experienced exporter looking to expand your global footprint or a new exporter starting your journey, TIQ can help you scale your business internationally.